Flying Cities: The rise of the Low-Altitude Economy

Introduction

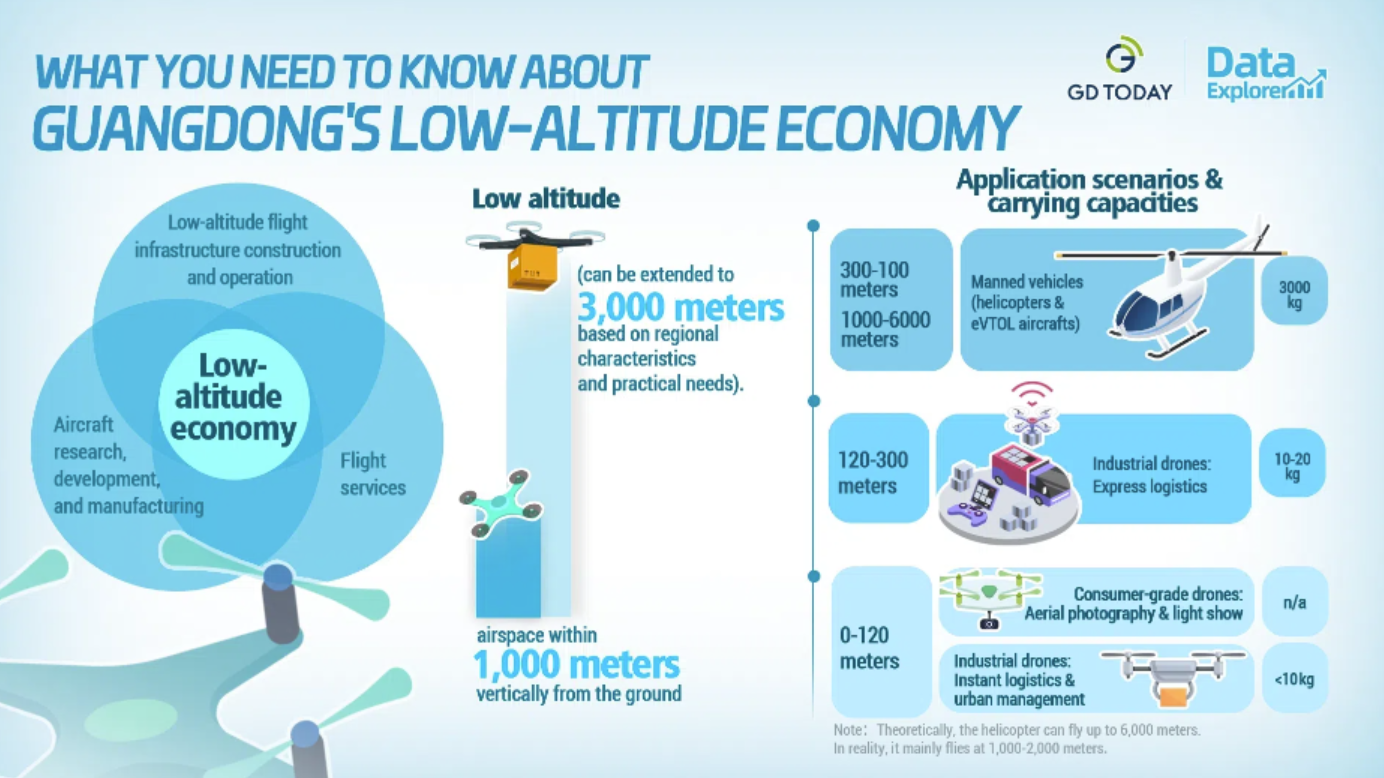

Can you imagine your DoorDash order flying through the sky instead of being delivered by a driver? In some Chinese cities, this is happening every day. In the 21st century, many technological advancements have driven a transition toward greater commercial productivity and greater convenience in daily life. The low-altitude economy (LAE) supports urban air mobility and is a strategic emerging industry with application scenarios spanning both personal and public services. The low-altitude economy refers to flight activities conducted within the low-altitude domain — typically between 1,000 and 3,000 meters — using manned or unmanned aerial vehicles like drones. The impact of the LAE spans throughout fields like the circulation, logistics, tourism, public safety, and agricultural irrigation industries. By transforming the sky into an economic resource, the LAE fosters China’s rise as a leader in shaping the next stage of urban living and innovative city design.

Overview of the Low Altitude Economy and its application. From What Is Low Altitude Economy?, by Grepow (2025).

Flying Machines: Types of Aircrafts Take Off

The leading mechanical transportation equipment in the LAE includes unmanned aerial vehicles, electric vertical take-off and landing (eVTOL) aircrafts, and air taxis. The types of unmanned aerial vehicles consist of multi-rotor, fixed-wing, and hybrid drones, gradually becoming a public infrastructure. eVTOL aircrafts, using electrical energy, achieve vertical takeoff and landing without a runway, expanding the city's construction vertically and conserving ground space. Air taxis are small helicopters that transport passengers in urban areas, becoming a solution to alleviate ground traffic congestion. Many aircrafts are also equipped with advanced hybrid and electric propulsion systems to improve efficiency and reduce emissions. Moreover, the Unmanned Traffic Management system provides algorithmic air governance with traffic coordination and automated routing (Grepow, 2025). Together, they reveal both the potential and challenges of the LAE.

China’s High-Flying Ambition: Leading the LAE

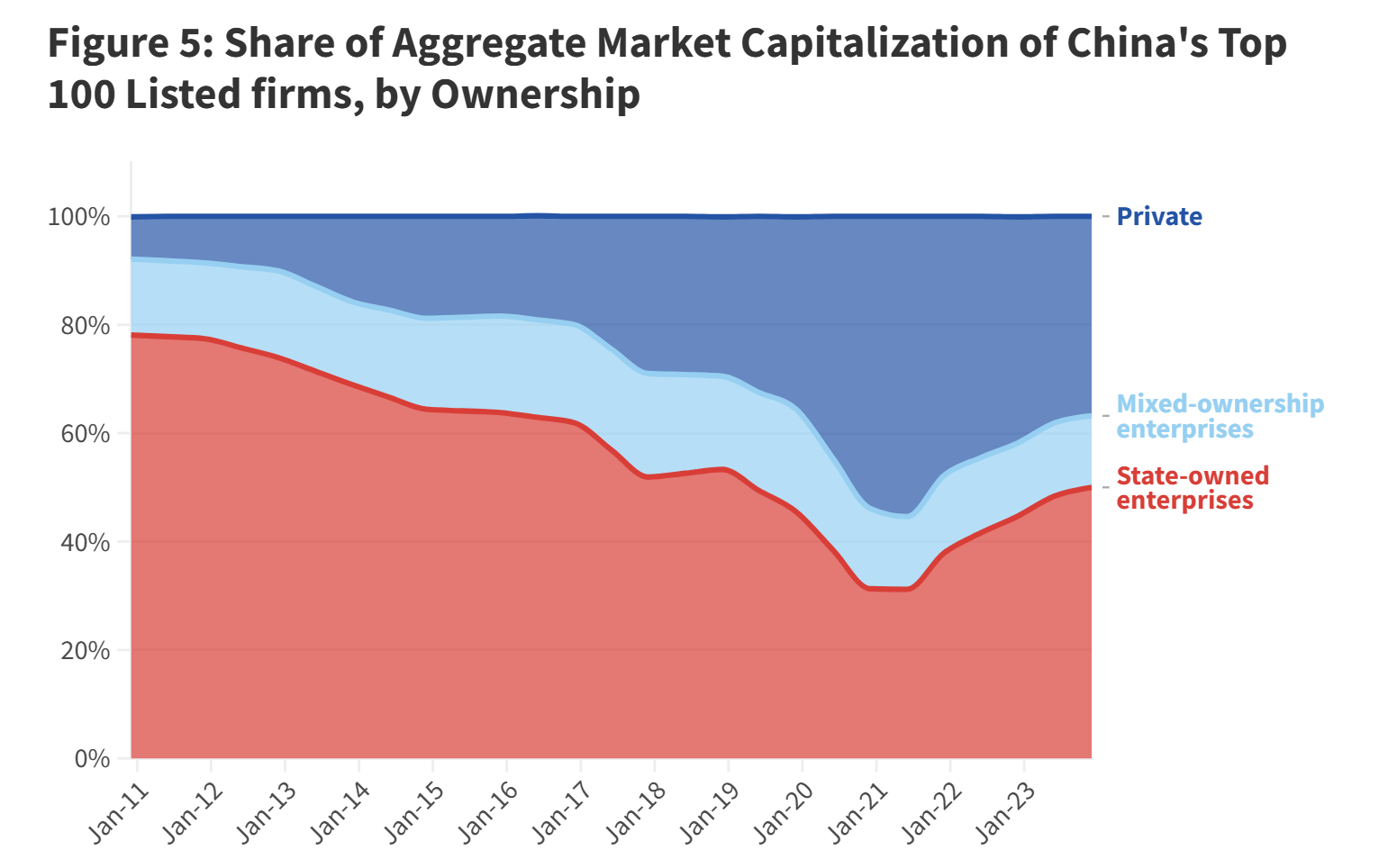

Under China’s communist economic framework, state-owned enterprises (SOEs) dominated critical sectors like energy, finance, transportation, and telecommunications, serving as a key engine of the national economy. Big Data China reports that SOEs held almost 50% of the combined market capitalization of the country’s leading firms. This dependence underscores China’s traditional investment-driven growth model. As China is known as “The World Factory” with its comprehensive industrial system and supply chain, it provides the foundations for mass production. The advantages of concentrated governance and large-scale manufacturing for the LAE lead to strong policy support, substantial investment, and high productivity. On the regulatory side, China became the first nation to formally integrate LAE provisions into its civil aviation laws in 2025 (Ibeawuchi, 2025). According to data from the Civil Aviation Administration of China, China’s low-altitude economy reached about $215 billion by the end of 2025 and is expected to reach $500 billion by 2035 (Xinhua, 2025).

Market Capitalization of China’s Top 100 Listed Firms by Ownership. From Unpacking Linkages Between the Chinese State and Private Firm, by Big Data China (2024).

The Vertical City: Air Mobility in the Greater Bay Area

China's geographical environment has also accelerated the development of the LAE. The high-rise buildings in Chinese cities make drone delivery more suitable and convenient. Unlike the scattered towns of Western Europe or the low-density areas of the American Midwest, China's tightly connected urban clusters and mountain areas have a strong demand for rapid logistics and air transport. The Greater Bay Area (GBA) is fully leveraging these advantages to test smart city and LAE initiatives in pilot areas such as Guangdong, Hong Kong, and Macao. With an economic output exceeding $2.15 trillion in 2025, as reported by the Macao News, the Greater Bay Area demonstrates growing capacity in developing low-altitude economy sectors such as tourism, intercity flights, air commuting, and emergency services. The GBA has formed two important “low-altitude economic cross-belts”: a manufacturing belt centered on Guangzhou, Zhuhai, and Foshan, and a financial services belt centered on Hong Kong, Macao, and Shenzhen (Yang, 2025). Therefore, with industrial specialization, digital infrastructure, and policy support, the GBA has formed a stable trade chain, accelerating logistics and economic growth at the regional and national levels.

Pioneers of the Sky: DJI, EHang, and AutoFlight

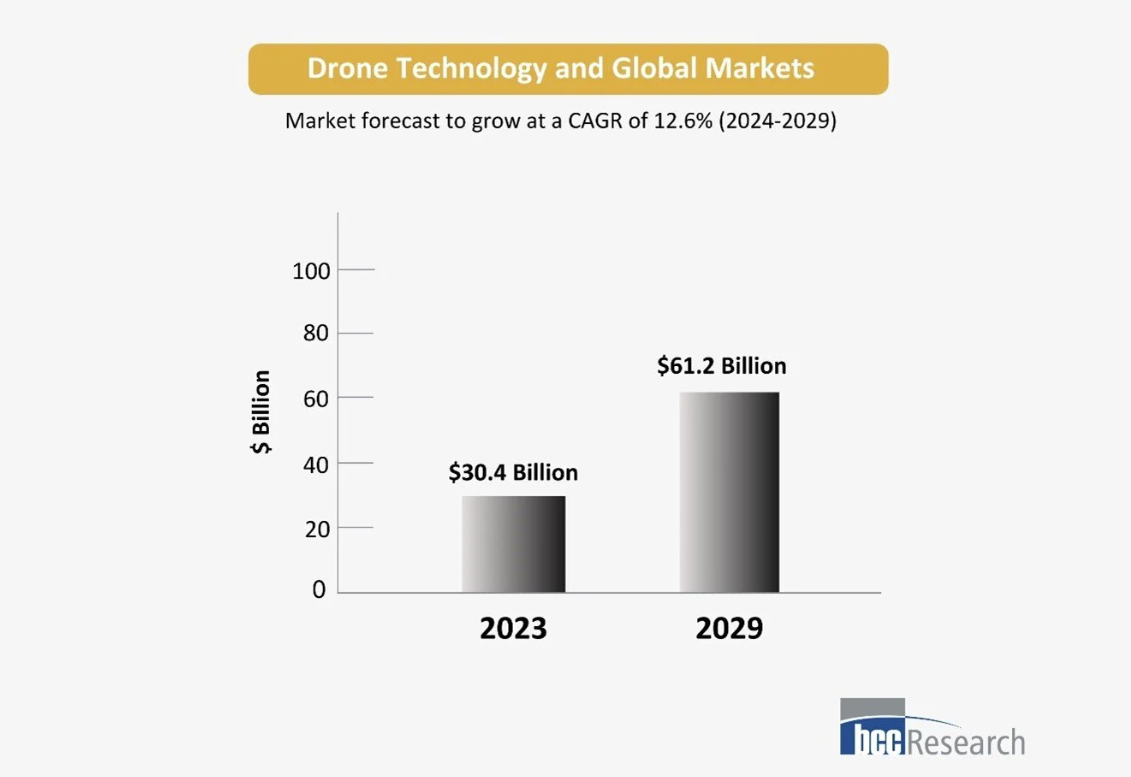

As pioneers in the global low-altitude flight revolution, Chinese innovative companies DJI, EHang, and AutoFlight are shaping the future of the aviation industry. The global drone market is projected to grow to $61.2 billion in 2029 from $33.9 billion in 2024, representing a compound annual growth rate of 12.6%. Shenzhen-based DJI holds over 70% of the global market share, with operations in more than 100 countries and regions (Arora, 2024). AutoFlight, specializing in long-range cargo drones, completed China's first intercity eVTOL flight from Shenzhen to Zhuhai with a 250km single-charge flight (Meszaros, 2025). EHang is dedicated to developing unmanned eVTOLs for passenger transport, tourism, and logistics — In 2023, Ehang became the first company in China to receive a manned autonomous flight certificate for its autonomous aircraft.

Market forecast for drone technology and global markets. From Top 10 Companies Leading the Drone Technology Market, by bcc Research (2024).

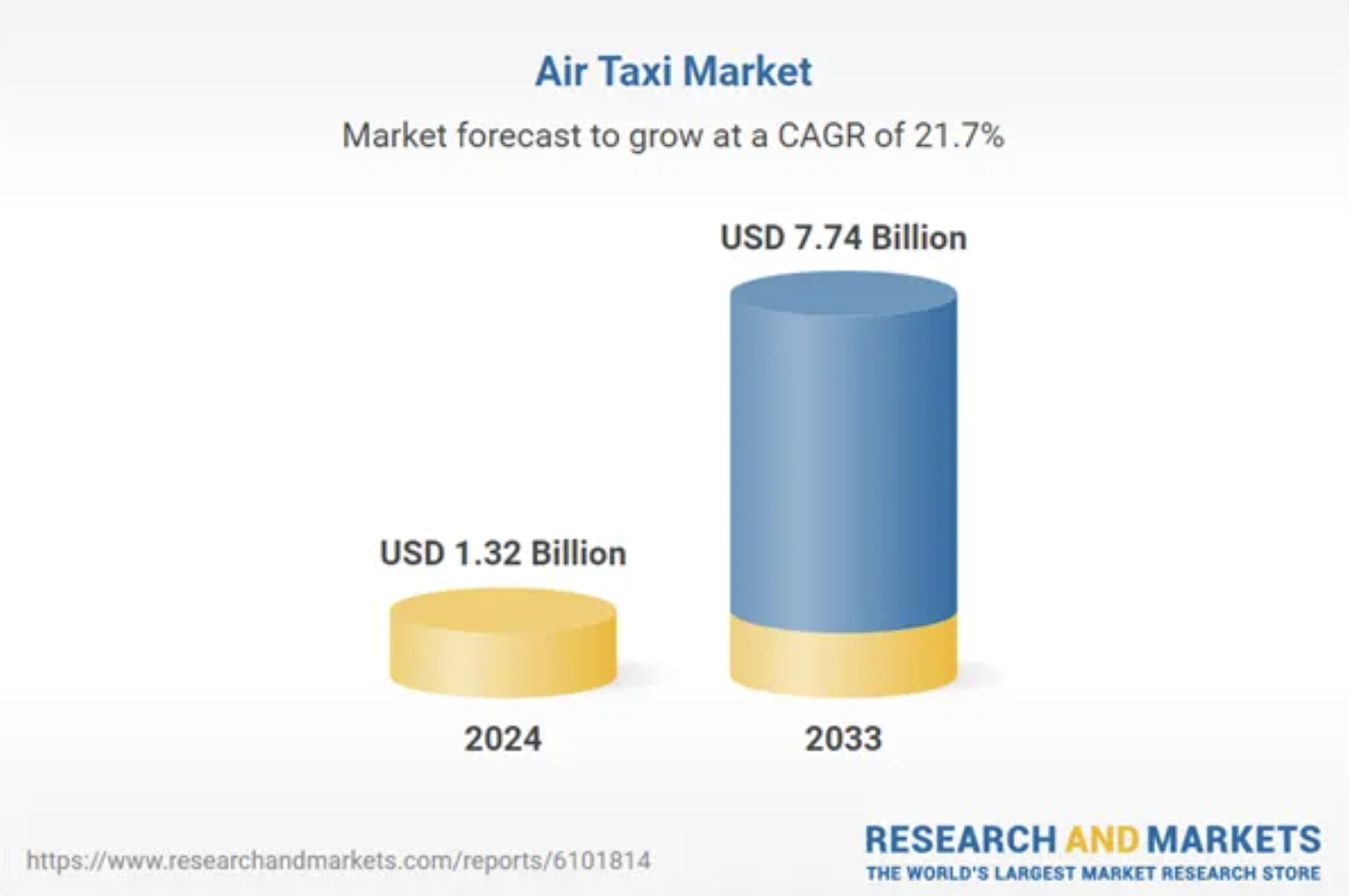

While technology brings new opportunities, real progress requires strategic planning. The Air taxi market trend exhibits significant growth potential both domestically and globally. According to Renub Research, the global air taxi market is expected to increase from $1.32 billion in 2024 to $7.74 billion by 2033, with an annual growth rate of 21.72% (2025). EHang enters the booming air taxi market with early regulatory approval and operational experience, giving it a strong lead. Under such rising policy support and global demand, EHang demonstrates its vision and advantages behind the rising LAE.

Market forecast for the Air Taxi Market in USD. From Air Taxi Market Size, Share, Trends & Forecast 2025-2033, by Renub Research (2025).

From Farm Fields to Roof Tops: Drones Transforming Daily Life

In China, drones have become a transformative force in the agriculture industry. As of October 2024, DJI had sold over 400,000 agricultural drones in more than 100 countries worldwide (DJI, 2025). In Bozhou, wheat fields are sprayed in just three days each spring. Nationwide, over 251,000 UAVs fly across billions of acres, performing agricultural tasks such as spraying, sowing, pollinating, and monitoring crops. The applications of drone technology also encompass forest fire prevention, river patrols, rural logistics, and elderly care in rural areas (Xinhua, 2025). In addition, China’s economy has historically depended on agriculture, with agricultural industries accounting for 15.29% of the national GDP in 2024 (National Bureau of Statistics of China, 2025). In this context, the use of drones improves productivity, supports rural public sector efficiency, and promotes sustainable development of the nation's self-sufficient economy.

Operation of a DJI agricultural drone for irrigation. From DJI Agras T100, T70P and T25P Launches Globally, by DJI (2025).

On the other hand, food delivery is a crucial component of China's service economy. Meituan and Ele.me, two major food delivery platforms, hold over 98% of China's online food delivery market share (Blazyte, 2025). According to The Economist, since 2021, Meituan drones have delivered more than 520,000 orders. As Meituan launched a drone delivery service on the Badaling section of the Great Wall in August 2024, drones flew from the rooftops of nearby hotels to the observation tower, delivering food, drinks, and emergency supplies to tourists. Each drone could carry 2.3 kg of goods, completing a journey of 50 minutes on foot in five minutes through air, with a delivery fee of only 4 yuan (approximately $0.56) (Gan, 2024). After the service, the drones transported the waste to nearby recycling stations, contributing to environmental sustainability. Therefore, drones, by reducing transportation costs, expanding supply chains, and improving delivery channels, have increased logistics efficiency, helping to meet growing demand and improve living standards in China.

Meituan drone delivery and pickup station. From IN FOCUS: What's low-altitude economy, and is China struggling to make it fly?, by Melody Chan / CNA (2025).

Navigating Skies: Challenges and Controversies Ahead

“Emerging markets remind us we won’t win unless everybody wins. We stay close to understand their challenges,” said Michael Miebach, CEO of Mastercard.

While the LAE is emerging and ambitious, it also presents some serious challenges. Firstly, as drones and eVTOL aircrafts rely on electricity, which is primarily generated from fossil fuels, indirect emissions create a contradiction between the goal of “green flights” and reality — greater efficiency for some, but higher emissions for all. Secondly, noise and privacy issues arise, particularly in heavily populated city areas. It is also plausible that low-flying could interfere with sleep quality, cause stress and leave residents at risk of unwanted surveillance by onboard cameras. This requires stricter regulation and enforcement of air traffic rules and privacy protections. Finally, cost is another barrier, as air taxi prices remain high; according to the booking website Tiketi, the average price of an air taxi in Shenzhen is about $5.73 per passenger mile, compared with an average of $0.62 per passenger mile for cars. If prices remain high, the LAE may repeat the mistakes of the early automotive era — revolutionary, but exclusionary.

Time, once considered the most egalitarian resource, has gradually become a privilege. When emerging technology widens the inequality gap, efforts to address it become the ultimate solution.

Edited by Nicolas Nemati

References

Arora, K. (2024). Top 10 companies leading the Drone Technology Market. BCC Research Blog. https://blog.bccresearch.com/top-10-companies-leading-the-drone-technology-market

Blazyte, A. (2025). Online food delivery in China - statistics & facts. Statista. https://www.statista.com/topics/7139/online-food-delivery-in-china/?srsltid=AfmBOoouypS9HEDBHyZnOSKcjbwlCwrQ24V69pIYw3iRFQ1AaKgTvSBT#topicOverview

Chan, M. (2025). In focus: What’s low-altitude economy, and is China struggling to make it fly? CNA. https://www.channelnewsasia.com/east-asia/china-low-altitude-economy-air-taxi-drones-policy-regulations-5419456

DJI Agriculture’s annual report reveals Drone-Powered Farming Revolution at Brazil’s Agrishow 2025 - DJI. DJI Official. (2025). https://www.dji.com/media-center/announcements/dji-agricultural-annual-report-2025

The Economist. (2025). China’s “low-altitude economy” is taking off. https://www.economist.com/briefing/2025/06/12/chinas-low-altitude-economy-is-taking-off

EHang. (2023). Ehang Unmanned Aircraft Cloud System approved by the CAAC; EH216-S positioned for post-TC commercial operations. https://www.ehang.com/news/984.html

Gan, N., & Tayier, H. (2024). Tourists scaling the Great Wall of China can now get takeout delivered by drone | CNN business. CNN. https://www.cnn.com/2024/08/22/tech/china-drone-delivery-great-wall-intl-hnk#:~:text=The%20drone%20delivery%20fee%20is,drones%20still%20need%20human%20help.

Georgia Institute of Technology. (2022). GT-Shenzhen, local transportation and Domestic Travel. https://www.shenzhen.gatech.edu/gt-shenzhen-local-transportation-and-domestic-travel/

Grepow. (2025). What are low altitude economy and low-altitude aircrafts. https://www.grepow.com/blog/what-is-low-altitude-economy.html

Ibeawuchi, B. (2025). The low-altitude economy explained: 2025 update. the dramatic transformation of Urban Air Space. Business Aviation. https://businessaviation.aero/evtol-news-and-electric-aircraft-news/low-altitude-economy/the-low-altitude-economy-explained-2025-update-the-dramatic-transformation-of-urban-air-space

Macao News. (2026). GBA economic output set to exceed 15 Trillion Yuan for 2025. https://macaonews.org/news/greater-bay-area/china-gba-economic-output-2025/#related

McKinsey & Company. (2021). McKinsey quote of the day. https://www.mckinsey.com/featured-insights/quote-of-the-day/november-3-2021

Meszaros, J. (2025). Chinese Evtol Aircraft Directory, part 1. News on electric vertical takeoff & landing (eVTOL) aircraft. https://evtol.news/news/chinese-evtol-aircraft-directory-part-1

National Bureau of Statistics of China. (2025). Value added of China’s agriculture and related industries takes up 15.29% of GDP in 2024. https://www.stats.gov.cn/english/PressRelease/202512/t20251231_1962219.html

Renub Research. (2025). Air Taxi market size, share, Trends & Forecast 2025-2033. Research and Markets - Market Research Reports - Welcome. https://www.researchandmarkets.com/reports/6101814/air-taxi-market-size-share-trends-and-forecast?utm_source=GNE&utm_medium=PressRelease&utm_code=3vz4f6&utm_campaign=2086759%2B-

Tiketi. (2025). Book an air taxi in shenzhen online: Cheap flying taxi fares. Tiketi.com. https://tiketi.com/flying/air-taxi/shenzhen/

Xinhua. (2025). China’s low-altitude economy boosts smart agriculture, Rural Development. http://wicinternet.org/2025-03/07/c_1076118.htm

Xinhua. (2025,). 市场最前沿逐空而上!低空经济加速启航万亿新赛道. 市场最前沿|逐空而上!低空经济加速启航万亿新赛道-新华网. http://www.news.cn/fortune/20251222/1a9ded8c452846a5a858f12866e39f07/c.html

Yang, F. (2025). City in the sky: Drones, Shenzhen, and the “low-altitude economy.” Made in China Journal. https://madeinchinajournal.com/2025/08/12/city-in-the-sky-drones-shenzhen-and-the-low-altitude-economy/

Ge, Z. (2025). Meituan’s drone deliveries booming in Shenzhen [Photograph]. VCG via Getty Images. https://www.gettyimages.com/